The groundbreaking Ecobank Mobile App, a single, unified financial services application across 33 African countries, has processed 9 million transactions worth over $1 billion since launch less than 18 months ago.

With over 4 million users, the Ecobank Mobile App is available to all, enabling users to open an Ecobank Xpress™ Account instantly on their mobile device (providing an easy route to financial inclusion for the previously unbanked). There are now over 4 million Ecobank Xpress™ Account holders on the Ecobank Mobile App and USSD platforms. Other bank customers may onboard the Ecobank Mobile App with their MasterCard or Visa cards while Ecobank customers do so using their card or retail internet banking credentials.

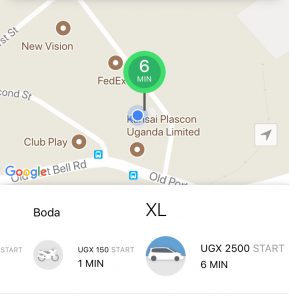

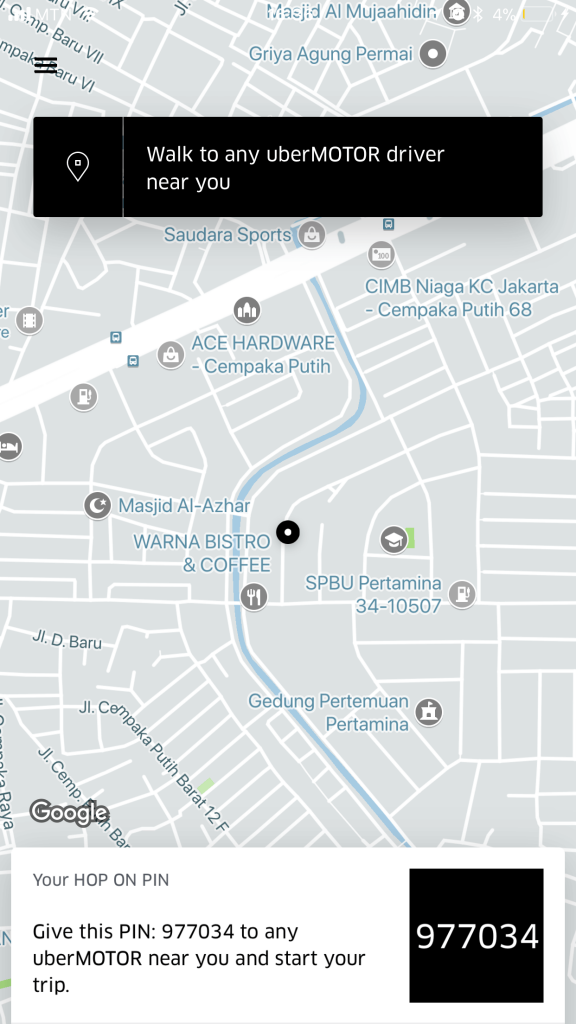

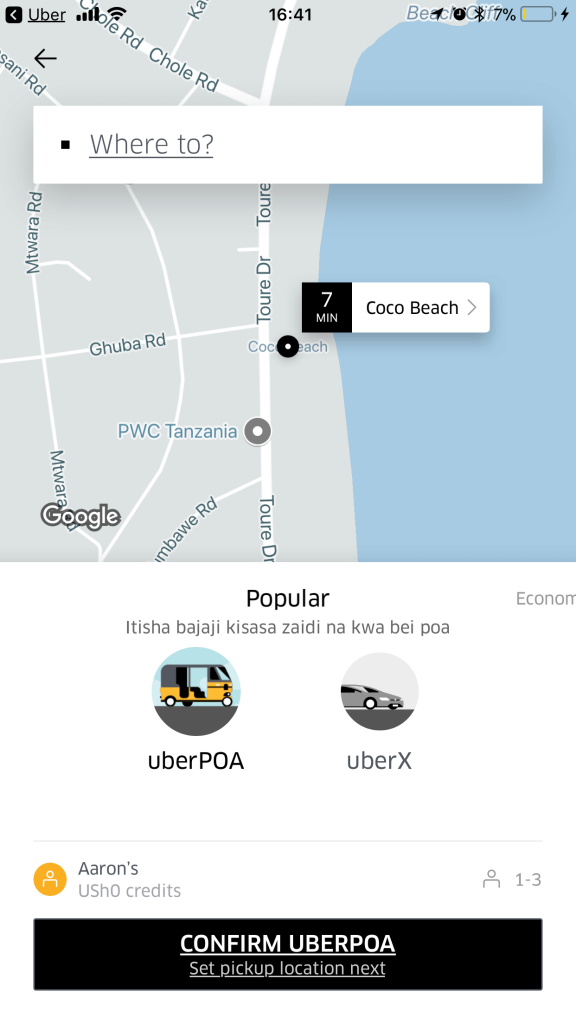

Users of the Ecobank Mobile App are able to transfer money instantly within Ecobank locally or across Africa using Ecobank Rapidtransfer™, a unique service that is faster and more affordable than competing options. Consumers may also make transfers to other local bank accounts, mobile wallets and to Visa cardholders using Visa Direct on the Ecobank Mobile App. The App offers easy payments using Ecobankpay Scan+Pay through Masterpass, mVisa and Mcsh, and has options to pay utility bills, school fees, subscriptions, make donations, buy airtime instantly and generate payment tokens using Ecobank Xpress™ Cash to do cardless ATM withdrawals or at an Ecobank Xpress™ Point (agent locations).

Ade Ayeyemi, Ecobank Group CEO explained that Ecobank’s strategic mission is built around using mobile banking to deliver innovative, efficient and cost-effective services to those who have typically sat outside of the formal economy, and therefore goes far beyond the reach of the traditional branch and ATM networks. He noted that they had processed almost as many transactions on the Ecobank Mobile App in the first few months this year as they did in the second half of 2017.

“Customers can enjoy 24/7/365 access to financial services from the convenience of their mobile devices with the Ecobank Mobile App,” he said. “We have brought world-class functionality to consumers in the 33 countries in Africa where Ecobank operates.”

Patrick Akinwuntan, Ecobank’s Group Executive, Consumer Banking says that Ecobank is committed to providing easy access to financial services for all Africans, leveraging the ubiquity of mobile phones via the bank’s Mobile App and at Ecobank Xpress™ Point agents wherever physical interaction is necessary especially for cash deposits.

“We aim to be the leading consumer financial services franchise in Africa and have developed a range of products and services relevant to meeting the daily banking, financing, investment and transactional needs of our customers,” said Mr. Akinwuntan. “The Ecobank Mobile App provides easy access to these services anytime and anywhere and we are very pleased with the fast and increasing uptake.”

The Ecobank Mobile App is available for download from the Google Play Store or Apple Store.