Walk into any bar in Kabalagala or hop into a taxi weaving through Kampala’s rush hour, and one soundtrack has defined Uganda’s year: Afrobeats. Nigeria’s cultural engine continues to roar across the country, shaping club playlists, radio rotations, and personal streaming habits. But beneath the heavy continental influence, a new story is taking shape — one led by Ugandan artists who are beginning to command their space.

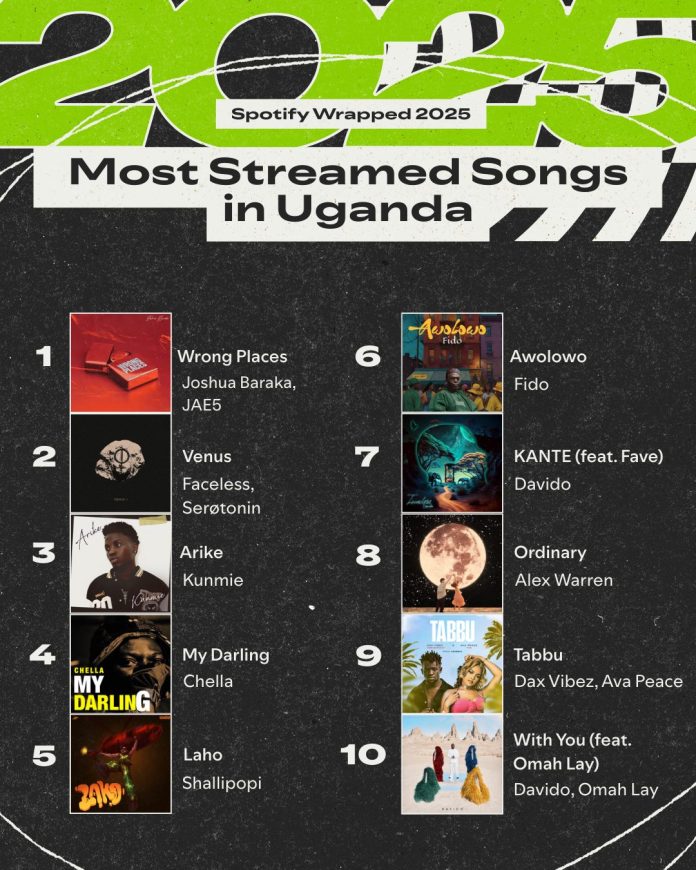

Spotify’s 2025 Wrapped data shows just how deeply the West African sound has embedded itself in Ugandan listening culture. Of the top 10 most-streamed songs in Uganda, seven are Nigerian. Tracks like Venus by Faceless and My Darling by Chella became near-inescapable staples, functioning like unofficial Ugandan anthems throughout the year.

On the Top Artists chart, global heavyweights Drake and Chris Brown sit alongside Afrobeats titans Burna Boy, Davido, and Rema. The Top Albums list tells a similar story, with Davido’s 5ive, Omah Lay’s Boy Alone, and Ayra Starr’s The Year I Turned 21 securing prominent positions.

Nigeria’s presence remains unmistakable, and for now, unshakable.

Joshua Baraka Outstreams Davido and Kendrick Lamar

Yet 2025 delivered a breakthrough moment that cannot be ignored. At number one on the country’s Top Songs list is a Ugandan, Joshua Baraka, with Wrong Places, his collaboration with British-Ghanaian producer JAE5.

Baraka’s rise has been steady and intentional. From his 2023 breakout Nana to his latest album Juvie, he has refined a sound that sits comfortably between soulful vulnerability and global polish. Pairing that with JAE5’s production gave Wrong Places the international sheen that propelled it past Davido and even Kendrick Lamar on Ugandan soil.

It’s the kind of homegrown win that signals a shifting tide.

Street Anthems and Local Chemistry

The surge didn’t stop with Baraka. At number nine is Tabbu, the electrifying collaboration between Dax Vibez and Ava Peace. Built on flirtatious lyricism and undeniable chemistry, the track became a nightlife favourite, proving that Ugandan duets can go toe-to-toe with the biggest international collaborations.

Further down the chart, the underground made a bold appearance. FYNO UG’s Che Che, rooted in the grit of African Dancehall, broke into the top 20, a strong signal of evolving local tastes and the maturing Kampala street sound.

Over on the Top Artists list, Elijah Kitaka is the next notable milestone. Landing just outside the top 10, the drummer-turned-Afro-soul vocalist has emerged as one of Uganda’s most refined musical exports. His single Good Idea, featuring Dax Vibez, helped solidify his rise.

A Shift in the Air

This year marked the moment when Ugandan artists stopped seeking validation and started dictating the pace. The charts still show the unmistakable pull of West African music, but names like Joshua Baraka, Dax Vibez, Ava Peace, and Elijah Kitaka reflect a growing appetite for local storytelling and soundscapes.

Uganda isn’t rejecting the Afrobeats wave — it’s learning to ride it on its own terms.

Spotify Wrapped 2025: Top Songs in Uganda

- Joshua Baraka, JAE5 — Wrong Places

- Faceless, Serøtonin — Venus

- Kunmie — Arike

- Chella — My Darling

- Shallipopi — Laho

- Fido — Awolowo

- Davido — KANTE (feat. Fave)

- Alex Warren — Ordinary

- Dax Vibez, Ava Peace — Tabbu

- Davido, Omah Lay — With You

Top Artists in Uganda

- Drake

- Chris Brown

- Burna Boy

- Davido

- Rema

- Ruger

- Asake

- Ayra Starr

- Kendrick Lamar

- Fireboy DML

Top Albums in Uganda

- Chris Brown — 11:11

- SZA — SOS Deluxe: LANA

- Davido — 5ive

- Omah Lay — Boy Alone

- Davido — Timeless

- Ayra Starr — The Year I Turned 21

- Kendrick Lamar — GNX

- Ruger — The Second Wave (Deluxe)

- Asake — Work Of Art

- Tyla — TYLA